Get the free payoff authorization form

Show details

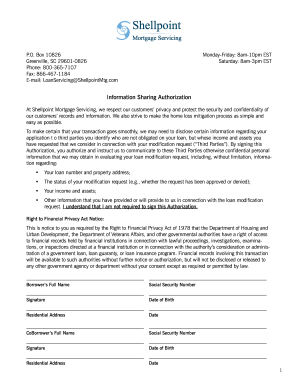

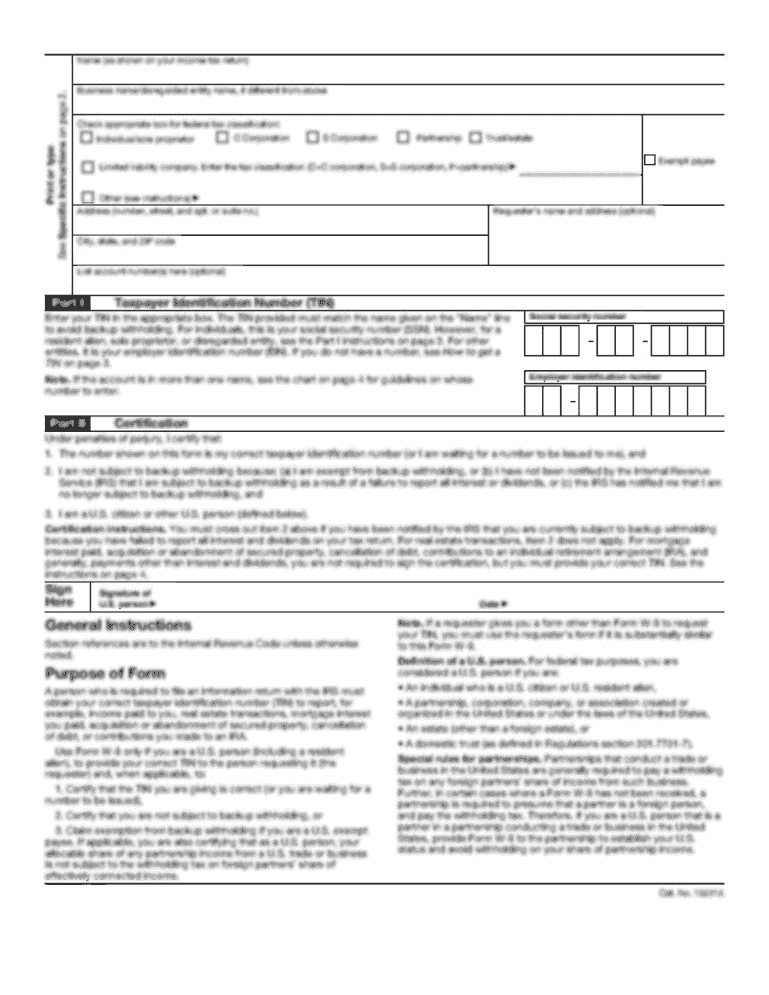

Loan Payoff Request Form To the Borrower Seneca Mortgage Servicing LLC will only release a mortgage payoff statement to the borrower or a person acting with written authorization. If you are requesting a payoff statement for yourself to be sent to you please complete and sign section 1. Borrower Authorization to release payoff to Third Party account s I hereby authorize the following person s and/or company to obtain a payoff statement for any of the above accounts I authorize Seneca Mortgage...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payoff request form

Edit your mortgage payoff request letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage payoff request form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sample payoff request letter online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit payoff request form template. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage payoff request letter template form

How to fill out mortgage payoff request form:

01

Gather necessary information: Before filling out the form, make sure you have all the required information handy. This may include your loan account number, the amount you want to pay off, and any additional instructions or requests you may have.

02

Download or obtain the form: Contact your mortgage lender or visit their website to obtain the mortgage payoff request form. Alternatively, you may be able to download it from their online portal or request a copy via mail.

03

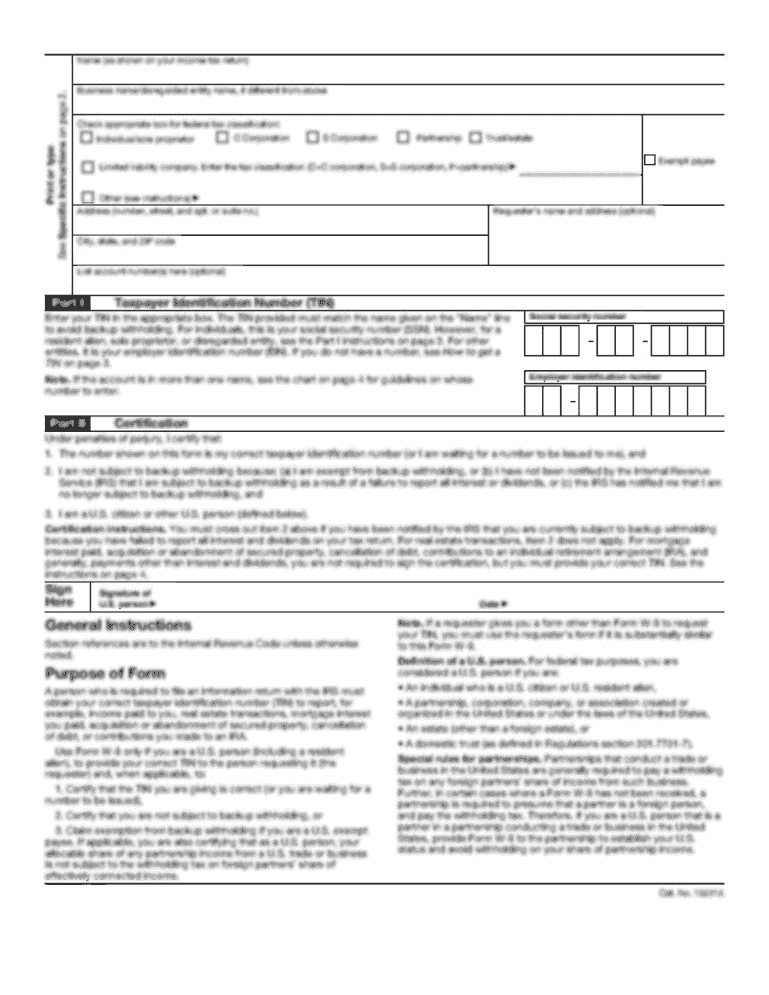

Provide personal details: Start by filling in your personal information accurately. This may include your name, address, contact number, and social security number. Ensure that all the details are correct and up to date.

04

Include loan information: Enter the loan details requested on the form. This may include the loan account number, loan servicer's name, and the current outstanding balance on the mortgage.

05

Specify payoff instructions: In this section, clearly state your desired payoff instructions. Indicate whether you want to pay off the entire loan balance or a specific amount. You may also need to provide instructions on how the payment should be applied if you have multiple loans or accounts with the lender.

06

Sign and date the form: Once you have filled in all the required information, carefully read through the form to ensure accuracy. Sign and date the form as indicated, confirming that the information you provided is true and correct.

Who needs a mortgage payoff request form?

01

Borrowers: Individuals who have a mortgage loan and wish to pay off their outstanding balance may need a mortgage payoff request form. This form allows them to communicate their intention to the lender and provide necessary instructions for the payoff process.

02

Lenders: Mortgage lenders require a mortgage payoff request form from borrowers to initiate the payoff process. It helps them verify the borrower's identity, account details, and instructions for the payment.

03

Financial institutions: In some cases, financial institutions other than the original lender may need to obtain a mortgage payoff request form. This can happen when a borrower wishes to refinance their mortgage with a different lender or transfer their loan to another financial institution. The new lender or institution may require a mortgage payoff request form to properly process the transaction.

Fill

to fill out a mortgage payoff request form the borrower what is a payoff amount

: Try Risk Free

People Also Ask about mortgage payoff letter form

Do you have to request payoff your mortgage?

Whatever the reason, their current loan must be paid off first before a new one can be issued. And in order for a borrower to know the exact amount they owe on their loan, they generally have to submit a payoff request to their lender.

When should you request a payoff quote?

If you need to know the exact payment amount necessary to completely pay off a loan, you'll need to ask your loan servicer for a payoff statement or payoff quote. This payoff amount will likely not be the same as the current loan balance on your monthly statement.

How do I write a mortgage payoff letter?

What are some of the key elements of a mortgage payoff letter? The date when the generated mortgage payoff amount expires. The official name of the bank to which the payoff amount should be sent. The destination account number to which the payoff amount should be wired.

What does it mean to request a loan payoff amount?

Your payoff amount is how much you will actually have to pay to satisfy the terms of your mortgage loan and completely pay off your debt. Your payoff amount is different from your current balance. Your current balance might not reflect how much you actually have to pay to completely satisfy the loan.

How do I request a loan payoff amount?

How do I find that amount? Your loan holder/servicer can provide your payoff amount, which will include principal and interest, as well as other fees and costs on your account (if applicable). Contact your servicer for your payoff amount.

How do I request a payoff on my mortgage?

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my payoff request letter directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your sample mortgage payoff request letter along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit payoff form from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your mortgage payoff authorization form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make edits in payoff authorization form pdf without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your private mortgage payoff letter template, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is mortgage payoff request form?

A mortgage payoff request form is a document that a borrower submits to their lender to obtain the total balance owed on their mortgage, including principal, interest, and any applicable fees, in order to facilitate the full repayment of the loan.

Who is required to file mortgage payoff request form?

Typically, the borrower or the individual authorized to act on behalf of the borrower is required to file the mortgage payoff request form.

How to fill out mortgage payoff request form?

To fill out a mortgage payoff request form, the borrower must provide necessary personal information such as their name, property address, loan number, and any other pertinent details requested by the lender to identify the account.

What is the purpose of mortgage payoff request form?

The purpose of the mortgage payoff request form is to formally request the payoff amount from the lender and to ensure that the borrower understands the total amount needed to pay off the mortgage completely.

What information must be reported on mortgage payoff request form?

The information that must be reported on a mortgage payoff request form typically includes the borrower's name, loan number, property address, contact information, and any additional details requested by the lender to calculate the payoff amount.

Fill out your payoff authorization form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Payoff Letter Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to loan payoff request form

Related to mortgage payoff letter pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.